Payroll Accountant

- On-site

- Palo Alto, California, United States

- $90,000 - $130,000 per year

- Finance

Job description

Target start date: Immediately.

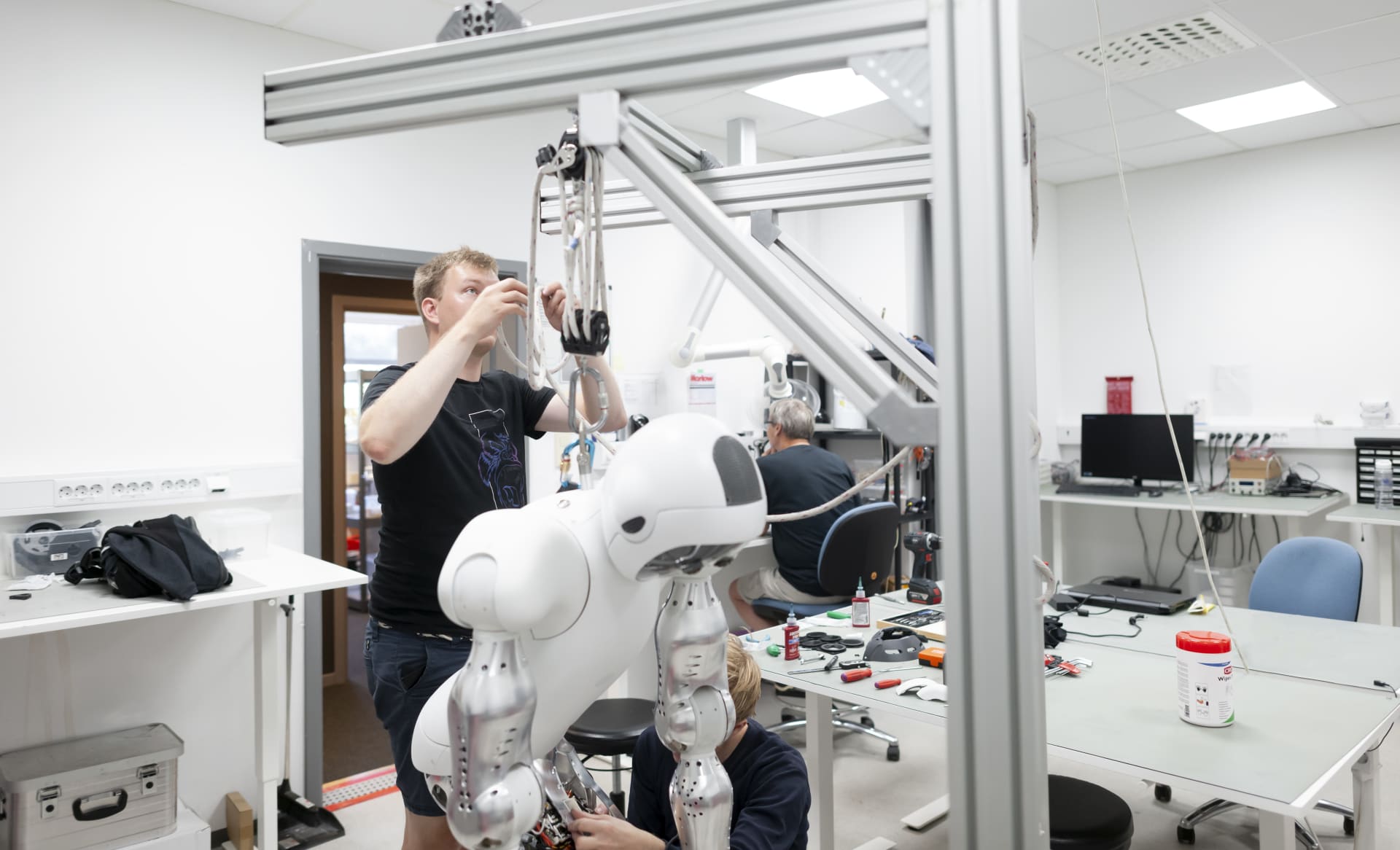

Since its founding in 2015, 1X has been at the forefront of developing advanced humanoid robots designed for household use. Our mission is to create an abundant supply of labor via safe, intelligent humanoids.

We strive for excellence in all we do, solving some of the hardest problems in robotics with the world’s most talented individuals. Every part of our robots is designed and produced in-house—from motor coils to AI—reflecting our vertically integrated approach. At 1X, you’ll own real projects, be recognized for your achievements, and rewarded based on merit.

We believe the best work is done when collaborating and therefore require in-person presence in our office locations.

We are seeking a detail-oriented and experienced Payroll Accountant to join our accounting team. In this role, you will be responsible for managing all aspects of payroll processing for both salaried and hourly employees in a fast-paced manufacturing environment. You will ensure accuracy, compliance with tax regulations, and timely payroll distribution. The ideal candidate has strong knowledge of payroll systems, excellent analytical skills, and a commitment to confidentiality and compliance.

RESPONSIBILITIES

Accurately process bi-weekly payroll for both hourly and salaried employees, including overtime, shift differentials, bonuses, and deductions.

Maintain payroll records in compliance with company policies and federal/state regulations.

Validate proper calculation and remittance of payroll taxes and benefit contributions.

Validate payroll journal entries for the general ledger.

Generate payroll reports for management, finance, and compliance audits.

Stay current with wage and hour laws, tax legislation, and reporting requirements.

Support HR and management with employee payroll inquiries and provide timely resolutions.

Assist with annual audits, W-2 processing, and year-end reporting.

Perform other related duties as assigned; responsibilities may evolve to meet business needs.

Job requirements

Qualifications:

3+ years of progressive payroll accounting experience.

Bachelor’s degree in Accounting, Finance, or related field.

CPA preferred, but not required.

Understanding of U.S. generally accepted accounting principles and practices

Strong knowledge of payroll systems (e.g., Rippling, ADP, WorkDay) – practical experience with Rippling is a plus.

Solid understanding of the U.S. federal and state payroll regulations, including wage and hour laws.

Strong Excel/Google Sheets skills and proficiency with modern accounting systems and ERPs (e.g., NetSuite, RAMP, Stampli)

Ability to meet deadlines and manage multiple priorities in a collaborative environment

Excellent organizational and communication skills.

Detail-oriented with strong analytical and problem-solving abilities

Startup or hardware experience is a plus, but not required.

Location Policy

This role is expected to be on-site, 5 days per week in Palo Alto.

Benefits:

Salary Range: $90,000 - $130,000

Health, dental, and vision insurance

401(k) with company match

Paid time off and holidays

We're excited to get to know you and the prospects of having you on board!

or

All done!

Your application has been successfully submitted!

Explore Careers at 1X.

Our mission is to design Androids that work alongside people, to meet the world’s labor demands and build an abundant society.